WHY THE ELON MUSK CHOICE OF BATTERY IN THE TESLA IS THE WORST DECISION IN

ENGINEERING HISTORY AND HE DID IT TO SCAM THE STOCK MARKET

By Audret Conners

Elon Musk knew from day one that his batteries were deadly. He knew this,

as fact before he took over Tesla in a hostile take-over.

Elon Musk, Tim Draper and Steve Jurvetson knew this before they invested

in Tesla.

They knew that the deal-with-the-devil that they made with Panasonic was a

scam to dump the dangerous batteries in the market.

Bernard Tse, one of Elon Musk's battery bosses, and his staff, told Musk

that his batteries were dangerous as far back as 2009

Musk has known that his battery system was a scam but he went ahead and

scammed the world any way.

Scientists have long understood that a lithium-metal anode would

theoretically pack in more energy. In fact, the first lithium-ion cells

that oil giant Exxon developed in the 1970s contained lithium-metal

anodes. (Exxon was working on batteries then because it worried that oil

might run out one day.) Single-use lithium-metal batteries were

commercialized about the same time and they are used even today in

specialized applications, such as deep-sea drilling.

Commercializing rechargeable lithium-metal batteries is a bigger

challenge. In the 1980s, Moli Energy, a Canadian startup, was the first to

succeed. But some of its batteries started catching fire, and the company

had to issue a recall. The incident led to legal action and Moli Energy

was forced to declare bankruptcy.

The use of lithium metal in rechargeable batteries creates three big

problems. First, it reacts with everything: water, oxygen, and even

nitrogen (all of which are present in the air around us), making it more

likely to catch fire.

Second, lithium’s reactivity means it suffers side reactions with the

battery’s liquid electrolyte, which is itself an energy-rich medium. These

undesirable reactions reduce the amount of lithium available and worsen

the battery’s life with every charge-discharge cycle.

Third, when a lithium-metal battery discharges, lithium ions separate from

the surface of the anode and travel to the cathode. When the battery is

charged the same ions travel back and deposit onto the anode as lithium

metal. But instead of forming a nice smooth coating on the anode, lithium

metal has the tendency to generate “dendrites,” chains of lithium atoms

growing from the surface of the anode, which look like the roots of a

tree. The dendrites grow bigger with each charge-discharge cycle,

eventually reaching the cathode and causing the battery to short, leading

to fires. Musk chose batteries whose dendrites grow the fastest, furthest

and are the oldest architecture. IN OTHER WORDS: TESLA'S ARE GOING TO

INCREASE THE AMOUNT THAT THEY BLOW UP!

As the industry struggled through these problems in the late 1980s, Sony

invented the graphite anode. Though less energy-dense, it suddenly made

lithium batteries a lot safer and more reliable. Since then, graphite

anodes have remained the mainstay of the industry.

Nearly 30 years later, however, we are brushing up against the

limitations of the graphite anode and Elon Musk still won't use one of

over 300 different energy energy storage systems because of the kickbacks

he gets from his deadly batteries.

Lithium ion mining is based in child labor camps in the Congo. Musk knows

this and covers it up. As Bloomberg's Nathanial Bullard points out,

Tesla's idea to "go private" is just another scam to try to keep the SEC

from looking too close:

You

may have heard that Elon Musk intends to take Tesla Inc. private.

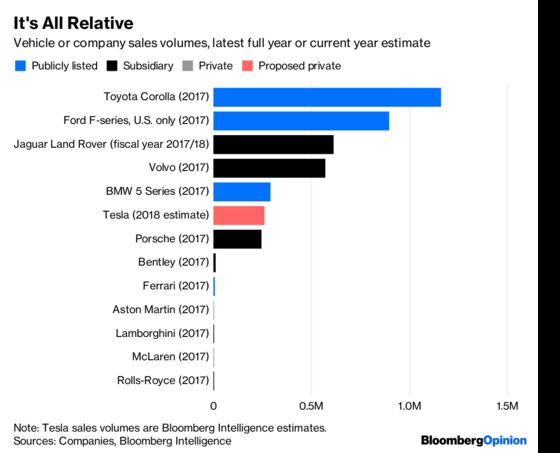

Tesla sold 103,000 cars last year,

which makes it the fourth-smallest listed carmaker by sales

volume, according to Bloomberg Intelligence. If Tesla becomes a

private company, its projected sales volumes would make it an

outlier in the auto sector.

In terms of output and sales, it

would be an extremely large privately held automaker: smaller than

a major automaker subsidiary and tiny compared to the biggest

listed firms, while producing as a whole a mere fraction of

certain popular vehicle models alone.

I’ll use Tesla’s 2018 projected

sales, which Bloomberg Intelligence estimates will reach 261,000

vehicles, to compare it to big automakers that have a high degree

of specialization. Those 261,000 vehicles equal 51 times the

output of Ferrari NV’s privately held supercar peer manufacturer

Aston Martin and 78 times the output of also-private McLaren

Automotive Ltd. A private Tesla would be a very big private

automaker indeed.

Tesla’s forecasted vehicle sales

are more akin to a subsidiary than to a standalone major carmaker.

It’s about the same size as Porsche, a subsidiary of Volkswagen

AG. It’s half the size of Volvo AB (owned by Geely Holding Group)

and about two-fifths the size of Jaguar Land Rover Automotive Plc

(owned by Tata Motors Ltd.).

At that production level, it’s not

even a big model: Tesla’s total sales would be less than BMW’s

sales of just its 5 Series model (292,000), and a minor fraction

of the sales of the Toyota Corolla (1.16 million) or the Ford

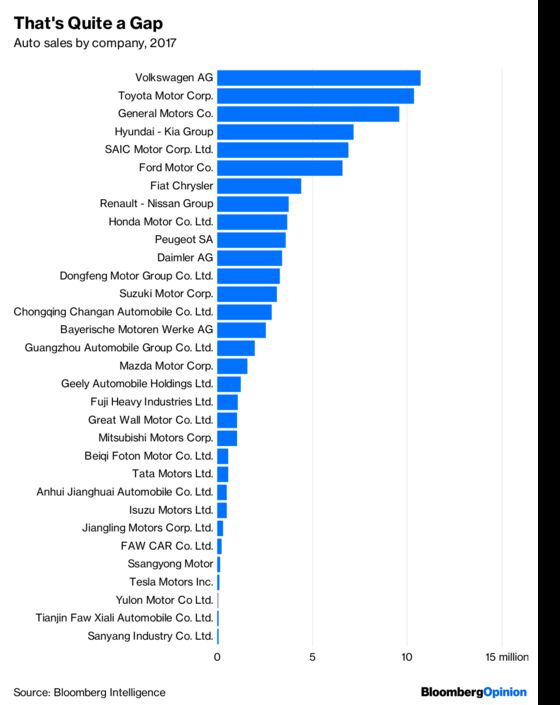

F-series pickup (897,000). Toyota Motor Corp. and Volkswagen AG

each sold more than 10 million cars last year. The auto market

really doesn’t have anything else like Tesla, even though the

company plans to reach half a million in sales within a few years.

Perhaps going private would allow

the company to pursue a strategy of relentless integration without

analyst and investor scrutiny. In a tweet thread the day before Musk announced

his plan,

Andreessen Horowitz partner Steven Sinofsky made the case that

Tesla’s “more purpose built engineering” will benefit mass market

cars — though it’s unclear if doing so would result in more market

share or higher profits.

A privately held Tesla would

indeed be an unusual creature in an industry that sells 93 million

vehicles a year and books $2.5 trillion in revenue.